Investment Banks and Blockchain

A fresh and upcoming era, blockchain technology is emerging as a game-changer as it seeps into diverse industries. And, the finance industry hasn't been one to shy away from capitalizing on blockchain's power. Below is a perfectly technical, info-packed read on how investment banks are integrating the technology into their middle-office functions.

“Blockchain technology is going to rewire all financial services.”—Tom Farley, former president of the New York Stock Exchange

Blockchain is streamlining multiple facets of core investment bank functions such as asset-liability management (also applicable to commercial banks), trade reconciliation, clearing and settlement, as well as deal escrow and collateral management. It's also being hastily adopted by some of the top investment banks, namely J.P. Morgan, Goldman Sachs and Morgan Stanley among others.

What's Inside

Asset Liability Management

ALM in banking. ALM in investment banks primarily involves management of liquidity risk and interest-rate risk. For instance, the liquidity risk (inability to pay off funds when due or at sustainable costs) banks face is tackled by ALM to mitigate risk levels. ALM monitors liquidity risk and positions the bank to meet liquidity and funding needs—all in timely fashion.

Current drawbacks. It's quite an arduous process. ALM requires transparent communication between different departments, access to data and forward-looking quantitative projections, as well as strategic capital/regulatory frameworks used to analyze a bank’s balance sheet.

These areas, particularly, may benefit from the introduction of blockchain.

Blockchain in Strategic ALM

By nature, blockchain makes data transparent. It verifies data by synchronizing a network of nodes containing bank information. With the application of blockchain, different departments of a bank can simultaneously access the same data, which can enhance communication across all necessary bank committees as they ensure risk is within feasible, authorized levels.

This is especially true for ALM's modern form: strategic ALM, a "proactive" process of risk management where the asset-side department closely aligns its strategy with the liabilities-side department. Blockchain relays data from both sides and lays cards down on the table. This increased transparency expedites the data-matching process and sets investment banks ahead of the game.

"70% potential cost savings on central finance reporting as a result of more streamlined and optimized data quality, transparency and internal controls."—Banking on Blockchain, Accenture

Blockchain's power also lies in its efficiency. It can eradicate the duplicate databases and inconsistencies held by a banks' counterparties. Indeed, a sound ALM data infrastructure would eliminate the need for intermediaries (manual spreadsheets, data management and collation, thereby reducing costs), a feature blockchain exercises by removing manual processes.

Trade Reconciliation

In the capital markets universe, a single trade order is entered into the systems of all those involved in that trade; counterparties maintain their own records of the transaction to ensure records from both sides match. As a transaction travels through the middle and back offices of an investment bank, a pocketful of errors may occur along the way—errors that are inevitable, costly and require manual intervention. Hence, the need for reconciliation.

Blockchain in Trade Reconciliation

Blockchain could reduce substantial capital and operating expenses currently associated with reconciliation. It may eliminate trade errors entirely and modernize back-office functions.

Decreased transaction errors and trade reconciliation. Inconsistent prices, incorrectly listed accounts, mismatched data entry, or insufficient funds. The need for manual reconciliation can be triggered by numerous discrepancy types and "roughly 10% of trading volume requires some manual intervention," according to Profiles in Innovation. Blockchain technology may automate this verification process through its consensus mechanism; it guarantees a form of authentication, or agreement, between databases of opposite parties.

More on the tech behind blockchain and a breakdown of the "consensus mechanism."

The technology scans for errors (e.g., incorrect account or order details) before a trade even processes. If any are found, blockchain prevents the trade from executing to begin with. In a way, post-trade reconciliation is superseded by a pre-trade process.

Streamlined back-office systems. With the lack of a need for manual reconciliation, middle and back office systems would see a reduced office headcount. All parties involved with confirming the details of a trade—DTCC, custodians, brokers & dealers, clients—may now do so through automated, specified trade attributes listed in smart contracts.

Clearing and Settlement

Current process. (1) A trade takes place. (2) Details of the trade—stock, price, number of shares purchased, etc—are sent to the broker who executed the trade, as well as the client who confirms these details. (3) After being posted to either party's books (usually the DTCC and custody banks), trade details are adjusted accordingly in both. (4) The trade is now ready for its security settlement for cash.

Key issues. Since parties hold and record multiple versions of a trade, any disagreements or uncertainty must be resolved through manual intervention. There's also a long settlement process. Sure, equities may trade in seconds. However, the process of actually settling that trade may take up to three days. This ties up liquidity and capital. What's more, there's a plenitude of wavering information with accounts frequently opening and closing throughout a trade's lifecycle. Information pertaining to such accounts are rendered useless.

Blockchain in Clearing and Settlement

Underlying blockchain is distributed ledger technology, which allows transactions to be recorded in multiple places. Using the technology could eliminate inconsistencies within parties altogether. For banks, blockchain can shrink settlement times and windows—in some cases, from days to just hours. Reducing the time frame consequently reduces the window in which risk may occur. Blockchain also optimizes the outstanding trades process. Brokers and dealers can commit less capital to outstanding, unsettled trades and repurpose capital towards other priorities.

"By applying blockchain to the clearing and settlement of cash securities—specifically, equities, repo, and leveraged loans—we estimate the industry could save $11-$12 billion in fees, OpEx, and capital charges globally... blockchain could also potentially eliminate significant additional costs across FX, commodities, and OTC derivatives.”—Profiles in Innovation, Goldman Sachs

Deal Escrow and Collateral Management

As you know, deal adjustments are made frequently. This calls for frequent escrow and collateral management services, and operational expenses rack up. Management costs run especially high because of the expertise required on multi-portfolio calculations and use of advanced software.

Blockchain in Deal Escrow and Collateral Management

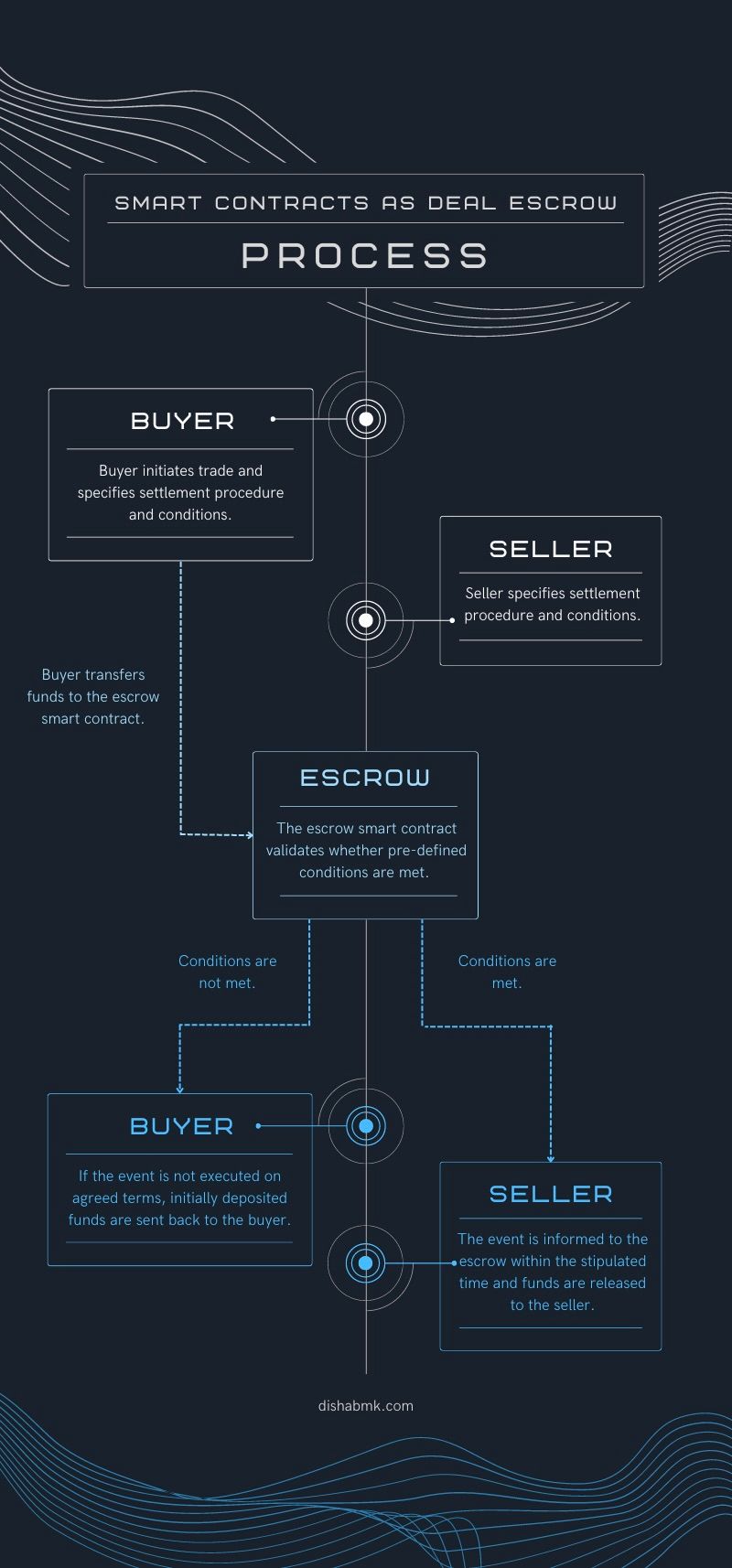

Blockchain technology cuts expenses from collateral management and the practice's need for risk absorption. Introduce the smart contract: tech that automates the process and plays the role of an escrow.

Smart contract process. (1) The buyer and seller specifies payment conditions as they would in any trade. (2) Funds are sent as collateral to the escrow smart contract. (3) The escrow, powered by blockchain, automatically validates whether the stated conditions are met at the time the deal is scheduled for. (4) Say, for instance, that the buyer was not able to deliver funds on their end. Simple "if/when" lines of code would notify the seller that the settlement requirements haven't been met. (5) Funds are automatically returned to the seller and the deal is canceled.

Smart contracts can "secure funding for the new investment position through automated payment channels... within minutes rather than taking an asset manager hours or days to complete."—BDO

In investment banks, this technologized form of collateral management would decrease the need for third parties as well as the service costs associated. However, transitions may be gradual, and third party groups may be called to facilitate transactions on blockchain. Additionally, because smart contracts objectively execute on code, they conveniently serve as unbiased third parties. This has the potential to reduce fraud present in escrow and collateral management services. Besides the transaction fees that may be needed to deploy the contract on public blockchains, this escrow alternative doesn't break the bank.

Others

Honorary mentions of management systems and blockchain's potential impact within them:

Cash Management and Payments. Increased efficiency and transparency within cash flow statements and cash books, which expedites day-to-day cash management.

Data Management. Heightened quality of data management across investment bank departments through solidified and foolproof record-keeping.

"99.9% of 'suspicious' financial transactions that end up being false positives upon manual review... [for which the] primary cause is poor data quality—which a tamper-proof, distributed ledger could improve"—Goldman Sachs

Trade Lifecycle Management. Reduced friction between financial intermediaries during trade lifecycle management (involving all steps from the point of order placed and trade execution through to settlement of the trade) due to data transparency.

Revenue Accounting and Control. Enhanced revenue accounting within investment bank middle-offices thanks to blockchain reducing the costs of maintaining and reconciling ledgers, and providing absolute certainty over the ownership and history of investments.

Top Investment Banks Using Blockchain

Banks are increasingly finding ways to weave blockchain into collateral settlements, securities lending, digital bonds, tokenized currencies and cross-border trades. Here's how J.P. Morgan, Goldman Sachs, and Morgan Stanley have been participating in the blockchain wave.

J.P. Morgan

JPMorgan isn't new to blockchain technology. They've been involved with the tech since late 2020 with their development of distributed ledger Quorum, and even began utilizing blockchain for repo trading.

According to bloomberg.com, JPMorgan’s repo platform powered by blockchain has seen “more than $300 billion of repo transactions… which counts Goldman Sachs Group Inc. and BNP Paribas SA among its participants.”

Recently, JPMorgan was involved with a notable collateral settlement. The trade's parties transferred BlackRock Inc.’s money market fund shares as collateral. Uniquely, it was done on the blockchain—and with token representations of the money market fund shares. The prospect of token substitutes allows investors to enjoy a greater selection of assets to pledge as collateral. In fact, JPMorgan plans to expand tokenized collaterals to include equities, fixed income and other asset types.

JPMorgan's indulgence in the world of digital assets, such as with their recent launch of Onyx Digital Assets (and their Blockchain Launch), sets blockchain on the path to becoming mainstream. And, institutional investors are more inclined to get exposure to DeFi platforms.

Blockchain technology opens doors to various types of collateral settlements—from derivatives and repos to securities lending. Not to mention, investors can do so outside of market operating hours; the process flows like water and settlements are almost instantaneous with blockchain.

Goldman Sachs

Goldman Sachs is in on the digital rush to build systems that are faster, more cost-efficient, and drive greater profits—all possible with the blockchain-based trading platform they are currently building. Indeed, Goldman Sachs is already trading bonds and debt securities for clients through the Ethereum blockchain network.

In 2021, they were the first major U.S. bank to trade crypto over-the-counter; it was a "a bitcoin-linked instrument called a non-deliverable option with crypto merchant bank Galaxy Digital" (cnbc.com). That same year, Goldman Sachs co-led the first issuance and settlement of a digital bond. It was a 100 million euro-dominated bond for the European Investment Bank (EIB)—a 2-year bond standard in all regards, except it was issued on Ethereum. For a highlight on the process detail, refer to this infographic.

"Issuing debt on the blockchain would allow firms to appeal to a much broader investor base by leveraging the programmability of the technology to fractionalize the digital debt or any financial instrument. In other words, it’s democratization in action."—Mathew McDermott, Global Head of Digital Assets

The significance of both Goldman Sachs' initiatives and the digital bond lies in blockchain's ability to increase access to traditional market participants and radically expedite the process; "normally, it takes five days after the transaction to settle debt issuance for the EIB, but because of the smart contract functionality and speed of transacting on the blockchain, we were able to settle it in one day," as stated by Maud Le Moine, Head of Sovereign, Supranational and Agency Origination in the Investment Banking Division.

Morgan Stanley

Morgan Stanley's involvements in blockchain strike a balance between erring on the side of caution and rolling out hefty investments—in line with their practical, yet optimistic view on the technology's growth long-term.

The bank's investment funds co-led a Series B funding round of around $48 million to help a digital securities platform, Securitize, fuel the adoption of tokenized securities (forbes.com). Essentially, Securitize is a blockchain-based trading platform that represents the “latest push to open up the high-walled private markets to the masses” (fortune.com).

“Our investment in Securitize is a sign that we believe in the growth and adoption of digital asset securities.”—Pedro Teixeira, Co-Head of Morgan Stanley’s Tactical Value Investing Team

The bank also partially owns DirectBooks, which is a corporate bond communication platform that recently partnered with a blockchain startup known as Axoni in February of 2021. And, earlier in January 2021, Morgan Stanley purchased “10.9% of the largest corporate bitcoin holder, MicroStrategy, and started offering some wealth management clients bitcoin exposure.” Indeed, Morgan Stanley was actually the first U.S. Bank to offer its wealth management clients access to Bitcoin funds. This is big, as the investment bank is a giant in wealth management with $4 trillion in client assets. Note that only the bank’s wealthiest clients—those with at least $2 million in assets held by the firm—have access to Bitcoin funds, and prerequisites are set in place to qualify as a suitable client.

In that regard, Morgan Stanley places high gravity on the safety of their clients due to Bitcoin’s volatility. Thus far, the firm has been a catalyst for urging the movement towards accepting Bitcoin as an asset class and is leading investments in blockchain platforms.

Conclusion

As of now, blockchain is not revolutionary—but rather evolutionary. Its current state does not have the power to replace certain things, the roles of trust banks and clearinghouses for instance. However, its impact in investment bank middle-office functions is tangible and inarguably positive.

With the intriguing technology, asset-liability management could see enhanced communication between bank departments and inconsistencies eradicated. Trade reconciliation may see a decrease in transaction errors and streamlined back-office systems. Clearing and settlement systems would experience a significant reduction in settlement time windows and risk, as well as an optimized outstanding trades process. Deal escrow and collateral management could see a lowered fraud rate and decreased need for expensive third parties. And, as top investment banks build the blueprint for use of blockchain, it opens a window of eye-opening opportunities as evident through first-hand experimentation within J.P. Morgan, Goldman Sachs, and Morgan Stanley.

The technology propels forward, and blockchain may be a crucial player alongside existing entities in the investment banking ecosystem.

References

- Banking on Blockchain - Accenture. https://www.accenture.com/_acnmedia/PDF-119/Accenture-Banking-on-Blockchain.pdf.

- Banton, Caroline. “Asset/Liability Management: Definition, Meaning, and Strategies.” Investopedia, Investopedia, 6 Oct. 2022, https://www.investopedia.com/terms/a/asset-liabilitymanagement.asp#:~:text=What%20Is%20Asset%2FLiability%20Management,and%20liabilities%20increase%20business%20profits.

- “Blockchain: Forging the Future of Asset Management.” BDO, https://www.bdo.com/insights/industries/financial-services/blockchain-forging-the-future-of-asset-management.

- Choudhry, Moorad. “Strategic ALM and Integrated Balance Sheet Management: The Future of Bank Risk Management.” The European Financial Review, Sept. 2017.

- “Digitizing Bonds on the Blockchain.” Goldman Sachs, 10 June 2021, https://www.goldmansachs.com/insights/pages/from_briefings_10-june-2021.html.

- “Escrow.” Blockchain Patterns, 22 Sept. 2021, https://research.csiro.au/blockchainpatterns/general-patterns/blockchain-payment-patterns/escrow-2/.

- Harty, Declan. “Securitize Launches Trading Platform in Final Push for 'End-to-End' Private Markets Offering.” Fortune, Fortune, 28 Sept. 2021, https://fortune.com/2021/09/28/securitize-launches-trading-platform-private-markets-offering/.

- Mason, Emily. “Morgan Stanley Co-Leads $48 Million Investment to Bring Blockchain to Capital Markets.” Forbes, Forbes Magazine, 21 June 2021, https://www.forbes.com/sites/emilymason/2021/06/21/morgan-stanley-co-leads-48-million-investment-to-bring-blockchain-to-capital-markets/?sh=4a06ec48ae1d.

- “Profiles in Innovation: Blockchain: Putting Theory Into Practice.” Goldman Sachs, 24 May 2016, https://www.gspublishing.com/content/research/en/reports/2019/09/04/916e112c-3150-40df-85df-9630090048de.pdf.

- Son, Hugh. “Goldman Sachs, Galaxy Digital Announce Milestone over-the-Counter Crypto Trade.” CNBC, CNBC, 21 Mar. 2022, https://www.cnbc.com/2022/03/21/bitcoin-options-goldman-sachs-announces-otc-crypto-trade-with-galaxy-digital.html#:~:text=Goldman%20is%20the%20first%20major,Galaxy%20Digital%2C%20the%20firms%20said.

- Son, Hugh. “Morgan Stanley Becomes the First Big U.S. Bank to Offer Its Wealthy Clients Access to Bitcoin Funds.” CNBC, CNBC, 18 Mar. 2021, https://www.cnbc.com/2021/03/17/bitcoin-morgan-stanley-is-the-first-big-us-bank-to-offer-wealthy-clients-access-to-bitcoin-funds.html.

- Sorrentino, Frank. “Banking on Blockchain.” Forbes, Forbes Magazine, 21 Apr. 2022, https://www.forbes.com/sites/franksorrentino/2021/11/29/banking-on-blockchain/?sh=28fafc1f70ed.

- Yang, Yueqi. “JPMorgan (JPM) to Use Blockchain for Collateral Settlements.” Bloomberg.com, Bloomberg, 26 May 2022, https://www.bloomberg.com/news/articles/2022-05-26/jpmorgan-finds-new-use-for-blockchain-in-collateral-settlement?leadSource=uverify+wall.