Intro to DeFi

Decentralized finance is a new, transformational way of thinking about financial transactions.

“DeFi takes the basic premise of Bitcoin—digital money—and expands on it, creating an entire digital alternative to Wall Street, but without all the associated costs (think office towers, trading floors, banking salaries).” —Coinbase

Find out what the umbrella of DeFi encompasses, what sets DeFi apart from both traditional finance (TradFi) and centralized finance (CeFi), its upsides and risks, and exciting and technical ways people are getting involved. The article also includes a deep dive into the current state of DeFi today, and whether it's truly the future.

What's Inside

- TradFi vs. DeFi vs. CeFi

- DeFi Benefits

- DeFi Risks

- Complex

- Impermanent Loss in Liquidity Pools

- Unpredictable—Unstable Stablecoin Pegs & Smart Contract Risk

- Expensive

- Low Regulation

- How Can You Get Invoved With DeFi Today?

- Staking (Lending)

- Getting a Loan

- Trading—Automated Market Maker (AMM)

- Earning Interest Income

- Buying Derivatives

- Will DeFi Be The Future?—Conclusion

TradFi vs. DeFi vs. CeFi

TradFi and CeFi are great starting points to understanding the complexities of DeFi. For an easy summary of the pros and cons of each approach to finance, check out this article.

Here's a useful layout of the most common platforms used.

Traditional Finance (TradFi)

Historically, intermediaries have been needed to conduct financial activities in a secure and legal way—the main activities being paying, trading, investing, saving, borrowing and risk management. As a result, most of today’s financial services are centralized, or controlled by numerous third parties and government agencies. The technologized options we have now, DeFi included, weren’t previously available.

There’s a few issues surrounding TradFi. Two are listed below:

Expensive service fees. With regular banks and corporations, the sole goal is to realize profits. At every step of a financial transaction, third-party institutions facilitate cash flows and charge fees for services. When customers purchase groceries, for example, even the merchant of the grocery store is subject to processing/assessment fees whenever their customers use credit cards.

Time-consuming. DeFi enthusiasts express another concern with TradFi: the time-consuming back-and-forth communication needed between intermediary parties for every transaction. For instance, here’s the underlying process for purchasing groceries with your credit card: (1) your merchant rings up your credit card, (2) the charge is alerted to the bank, (3) the bank sends your card details to the card network for clearance, (4) the network then clears the bank’s request so the bank can (5) approve the charge and (6) ultimately deliver the money to the merchant.

Decentralized Finance (DeFi)

DeFi strives to tackle some of these major issues.

According to coinbase.com, DeFi is “an umbrella term for financial services on public blockchains, primarily Ethereum.” Put differently, it delivers today’s financial services using blockchain technology. When it comes to DeFi, it inherently strips the power from banks and financial institutions by removing third parties. Rather than relying on third parties, the technology performs the work for us.

Note, DeFi is mainly geared towards use with cryptocurrency and built on the idea of stablecoins—coins backed by fiat currencies such as the dollar. Because stablecoins are pegged to monetary assets, they are considered more stable and safer than other cryptocurrencies. They’re also most likely the key to turning DeFi mainstream.

DeFi is beneficial in a few ways:

Increased access to financial services. All you need is an internet connection, and users can lend, trade and borrow through various softwares (more on blockchain technology later). Users are now directly connected, which eats away the need for third parties and their complimentary service fees altogether. Consequently, these lowered transaction expenses widen the number of people DeFi is able to reach.

DeFi takes precedence over CeFi models by “enabling anyone to use financial services anywhere regardless of who or where they are.” —Investopedia

Reduced transaction times. It’s a much faster process—thanks to technology. People, merchants and businesses directly conduct financial transactions through what is called peer-to-peer (p2p) financial networks, made possible by the fascinating prospect of Web 3.0.

Lowered transaction times are also a natural result of users having greater control with their money, via personal wallets and individually-catered trading services that increase usability.

“Transfer funds in seconds and minutes,” as DeFi eliminates banks from the equation. —Investopedia

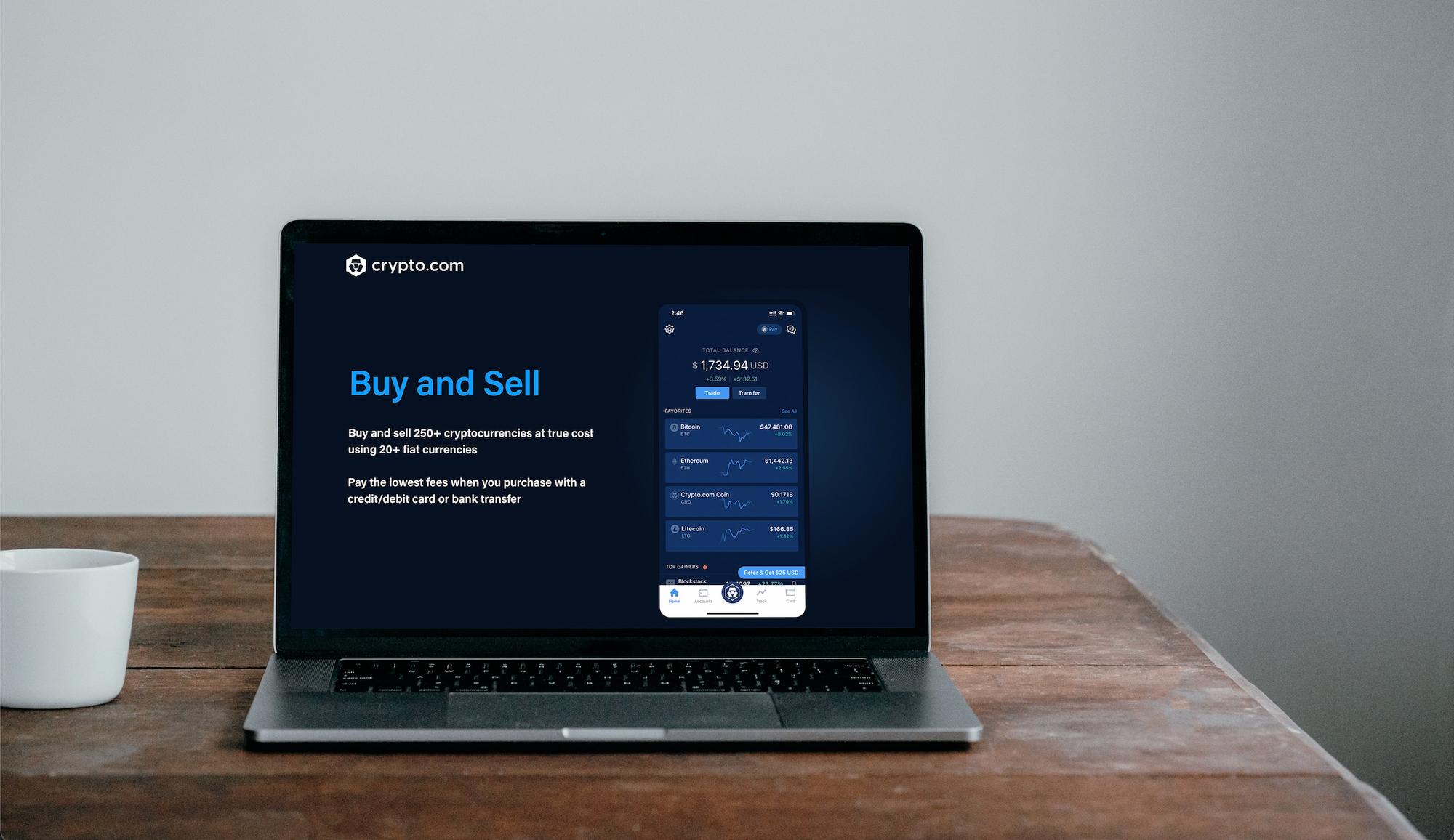

Centralized Finance (CeFi)

CeFi is another important angle to consider, and differs from DeFi in quite a few ways. Think of CeFi as a mainstream, regulated version of DeFi, where DeFi lies on the extreme end of the strip-power-from-third-parties spectrum. If you want an in-depth comparison of DeFi vs. CeFi, here is a useful resource.

Here are CeFi’s main distinctions from DeFi:

More secure. CeFi crypto platforms are easy to use and offer an extra cushion of security, primarily due to their more traditional financial-services products. CeFi is also synonymous with general crypto trends: “global, peer-to-peer… pseudonymous, and open to all,” and you can “earn interest on savings, borrow money, spend with a crypto debit card, and more.” However, DeFi lets you do a lot of the things that banks support, like “earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more—but it’s faster and doesn’t require paperwork or a third party.” When it comes to customer service, CeFi takes the win by a long shot with its fanciful plethora of support systems.

Greater regulation. CeFi has regulatory practices in place, such as Know Your Customer (KYC) and Anti-Money Laundering (AML), making all user accounts tied to specific, non-anonymous users. One popular example of a CeFi exchange, Coinbase, is actually registered with the Securities and Exchange Commission (SEC), bolstering regulation efforts.

Although CeFi may have its perks, DeFi maintains its own advantages.

DeFi Benefits

We’ve delved into the woodworks of each finance approach and DeFi's distinctions. Now, we’ll carve out the advantages of DeFi, which entails its openness, pseudonymity, flexibility, enticing level of control, speed and advanced transparency.

Open

It’s an open space that mostly anyone can enter. There is no long-winded process or paperwork needed to apply for or open accounts.

Pseudonymous

Personal information, including names or email addresses, is not a requirement for opening accounts. However, pseudonymous does not mean anonymous; transactions can still be traced back by entities who have access to them, like government or law enforcement.

Flexible

Most transactions in the DeFi space are unrestricted. They're also highly functional:

“You can move your assets anywhere at any time, without asking for permission, waiting for long transfers to finish, and paying expensive fees.”—Investopedia

Greater Control

Unlike traditional systems, DeFi allows lenders to decide the percentage of their funds that they want to make available for borrowing. There’s also “no minimum deposit periods to adhere to; the lender can decide how long to keep funds in their account without penalty” (medium.com).

Lenders can even specify the collateral they desire on each loan, which involves digital collaterals like other cryptocurrencies and digital assets. A digital asset is the "tokenized form of any asset that can exist digitally. These include online game assets, graphic design, photographs, videos, documents such as title deeds, and more."

Fast

With the effortlessness of technology, interest rates and rewards are rapidly updated “as quickly as every 15 seconds” and can be significantly more gainful than traditional Wall Street.

This compelling platter of technology includes decentralized applications (dApps) and smart contracts. DApps are simply DeFi's digital applications that run on blockchain technology and, for instance, automates the process of matching you to a loan lender with your specific criteria. Smart contracts can be options contracts, swaps or coupon-paying bonds that self-execute from lines of code.

Transparent

Unlike private corporations which conceal the full set of transactions, DeFi grants all users this level of transparency. In fact, lenders can see exactly which borrowers use their funds and how they used it on the platform in real-time. By doing so, DeFi strives to take the power from companies and hand it back to users.

DeFi Risks

DeFi may currently seem like an open playground, but the freedom and flexibility draws some risks, including its complexity, unpredictability, high cost, and scant regulation.

Complex

DeFi applications have not yet reached an easy user interface, as most processes are still developing. And, to understand the space and compete for profits, you must have vast technical knowledge encompassing both finance and technology.

Impermanent Loss in Liquidity Pools

When providing liquidity to a liquidity pool, there is always the risk of the price of your deposited assets changing; the value of your liquidity fluctuates and potentially diminishes over time. Impermanent loss translates to you withdrawing your deposit for a lesser dollar value than your initial deposit value.

Unpredictable—Unstable Stablecoin Pegs & Smart Contract Risk

As of now, DeFi financial markets are highly unpredictable; depending on the dApps you end up using and how you use them,

“Your investment could experience high volatility—this is, after all, new tech.”—Coinbase

Indeed, stablecoins could lose their peg and cause mass liquidations downstream.

On top of that, users need to be comfortable losing some—or even all—of their investments in case there’s buggy code, hackers, or just user error. For instance, with smart contracts, "newer, riskier protocols will often offer 1000%+ APY's to bring in new users, but these same protocols tend to be less battle-tested" and users should diversify portfolios accordingly.

Expensive

A seasoned investor must consider the waves of fluctuating interest rates on the Ethereum or Solana blockchain. Unbeknownst to these rates, active traders may get the expensive end of it.

Low Regulation

DeFi can be very dense and foggy to enter, since “you have to maintain your own records for tax purposes. Regulations vary from region to region.” Regulation is low overall due to the nature of DeFi and many recommend a “buyer beware” approach when dealing in these unregulated markets.

How Can You Get Invoved With DeFi Today?

Check out this article for an advanced read on DeFi and tactical ways to get started. Below, is a simpler, high-level discussion on ways people are interacting with the DeFi space.

DeFi platforms are perfect for those who require funds quickly but may not meet the stringent requirements set by traditional financial institutions; "for example, someone may not have the required collateral or credit history, or even hold an account at the financial institute because they may not meet the minimum deposit amount to open one" (medium.com).

You may even be captivated to jump in on investment opportunities in DeFi projects—those still young, in early stages of growth, and early enough to reap profits

These are the main DeFi avenues people are using today—abstracted from Coinbase:

Staking (Lending)

By lending, you (1) gain interest on your liquidity and (2) earn native tokens of the respective DeFi platforms you use.

You can earn interest and rewards “every minute—not once per month.”

It doesn't stop there. Owning a platform’s tokens becomes the ticket for governance of the platform. Put differently, maintaining a staker position is fruitful as it grants you a leveraged vote in certain decisions pertaining to how the DeFi platform is governed. In some platforms, the more tokens you hold, the more power your vote holds.

A few examples on issues that stakers may vote on include the interest rate on borrowing, the rate of incentive for token holders who provide liquidity, and what other dApps can be developed using the platform’s blockchain (if any)—another representation of power decentralization in DeFi, with users tasked on fund-management decisions.

Getting a Loan

Loans are instantaneous. One class of DeFi loans, called “flash loans,” are exclusive to DeFi and are extremely short-term. What's great about DeFi is that the process of finding a lender with your preferred criteria is automated, as well as the receiving and paying processes which occur through blockchain technology.

Trading—Automated Market Maker (AMM)

DeFi enables p2p (peer-to-peer) trading of crypto assets, similar to buying and selling stocks without an actual brokerage.

This is possible, thanks to automated market makers (AMM's). AMM's are decentralized exchange (DEX) protocols that allow users to transact assets using a pricing algorithm. Binance explains it best: "an AMM works similarly to an order book exchange in that there are trading pairs–for example, ETH/DAI. However, you don’t need to have a counterparty (another trader) on the other side to make a trade. Instead, you interact with a smart contract that 'makes' the market for you."

Earning Interest Income

There are high chances that putting your crypto into DeFi alternatives to savings accounts earn you better interest rates typically received from a bank. That said, be sure to understand all the risks involved.

Buying Derivatives

If you're a sophisticated trader, you can toggle with long or short bets on certain assets—which can be considered the “crypto version of [long and short positions in] stock options or futures contracts.”

Will DeFi Be The Future?—Conclusion

Smart contracts, high speeds, generous rates—DeFi seems to have it all. But the verdict on whether its benefits outweigh its risks remains on the table. The question lingers, is DeFi here to stay?

Here's the answer. It poses a threat to today's banks, influences a multitude of industries with its Web 3.0 solutions, sees promising adoption and veers towards more environmentally-cautious processes. Yet, DeFi calls for tricky compliance and regulation efforts and its tech is still far from its potential. Though it may not be the near future, it may eventually hold a solid spot in the future of finance—provided that it resolves its shortcomings.

Blockchain is potent because its security is applicable in numerous industries, outside the realm of finance. As its usage permeates across the globe, it challenges the future vision for traditional banks; traditional institutions will progressively recognize the inherent security of the blockchain. And, although extreme proponents may advocate that DeFi will completely wipe out the middleman, it is more likely that traditional banks will attempt to capitalize on trends first and create "yield-farming opportunities for their clients to participate in."

Banks will offer various DeFi products "to stay competitive and relevant."—Bankrate

That's not to say that the path to adoption for banks will have easy stepping stones. To integrate blockchain technology, it would "require revision of many well-established processes while opening them up to additional risks... More so, subject to regulation, these institutions would need approval for these activities from regulators." Chances are, CeFi will have an easier risk and compliance process and see its breakthrough before DeFi.

For the regular user, DeFi is already seeing a large range of adoption. The current ecosystem is intensive.

However, though many are toggling and experimenting in this new world, the platforms and tech upon which DeFi is built is laggard in its usability. Indeed, the actual tech hasn't caught up to the valuations yet and a series of blockchain outages last January left a grim impression on investors: it "left traders unable to sell off their positions because the transactions would fail." This Forbes article paints a no-BS, conservative picture of DeFi deficiencies, and lays out worthy concerns still relevant today.

For optimists, the recent slump is just a period where engineers perfect their craft, in tandem with typical innovative business cycles. It may not be the end-all: "the downturn will allow engineers that really care about building good products for decentralized finance to focus on perfecting them, and give new players the chance to enter the space for less" (fortune.com).

"Get ready for the next round of innovation."—Fortune

Indeed, the numbers continue to climb, and the growth prospective for DeFi is steady; the top 10 DeFi cumulative revenue is $4.66 billion as of July 6, 2022 (theblock.co).

The current state of DeFi's project value and revenue is down due to choppy trading in cryptocurrency markets, in tandem with today's generally turbulent economic trends.

The Value Locked by DeFi Project is calculated by reporting the "total value (USD) of all ETH and other ERC-20 tokens locked in the corresponding smart contracts"; in 2022, the total declined from $109.64 billion in May 1 to $46.64 billion in July 1 (theblock.co). Monthly DeFi revenue stats are also waning. Out of the total amount of revenue generated for DeFi users and token holders in June 2022 ($117.71 million), Uniswap accounted for $93.14 million of revenue collected (theblock.co). It clearly takes the lead within currency exchanges and DEX protocols.

A final angle to consider: DeFi's sustainability. When the concept of cryptocurrency first emerged and Bitcoin was first dazzling in the eyes of curious onlookers, it faced major backlash. Mining Bitcoin required massive amounts of energy, resulting in a torrent of detrimental CO2 emissions. DeFi platforms, however, are more environmentally conscious. The two blockchains most of DeFi is built on, Ethereum and Solana, recently switched over to a power-efficient, faster and cheaper consensus mechanism called PoS (Proof of Stake).

"About 99% more energy-efficient. Under proof of stake, transactions are confirmed by addresses that have staked—pledged to a smart contract—lots of Ether, or ETH... While proof of stake conceptually makes the rich richer, it doesn’t boil the oceans, either."—Decrypt

DeFi is undoubtedly an exciting field and era. It's openness, pseudonymity, flexibility, increased level of control, speed and convenient transparency inspires a multitude of possibilities in the financial industry. However one decides to jump into the space, if at all, be sure to do the necessary research and take the proper precautions. It is an especially risky space, one that is complex, unpredictable, involves high costs, and maintains little to no regulation. In whichever avenue—staking, getting a loan, trading, earning passive income, or purchasing derivatives—DeFi has the potential to disrupt and it is only is its initial stages.