Simplifying Decentralized Applications

The rise of blockchain sparked the emergence of numerous decentralized applications. They have gained increasing relevance as users increasingly seek solutions to protect and regain control of their data. Decentralized applications also have newfound use cases in business: "not only can dApps improve security protocols, but dApps can also help businesses grow unlike ever before" (forbes.com).

"A renaissance of peer-to-peer interactions, enabling a new generation of user-developed content, applications, and services that are supercharged by the existing infrastructure of the internet."—Murray, Alex, et al.

This 4-minute read breaks down concepts like decentralized applications (dapps), decentralized exchanges (DEXs), and decentralized autonomous organizations (DAOs).

What's Inside

Decentralized Application (dapp)

Dapps, or dApps, are “digital applications that run on a blockchain network of computers instead of relying on a single computer” (investopedia.com). Because there is no single point of failure, dapps are more reliable. Consider an app with centralized servers: Instagram. If Instagram were to crash, all users would lose access to the platform.

Dapps, however, have an ever-lasting existence. They can't be taken down once deployed on a blockchain like Ethereum. That's true even if the team behind the dapp disbands; users could continue to access the dapp.

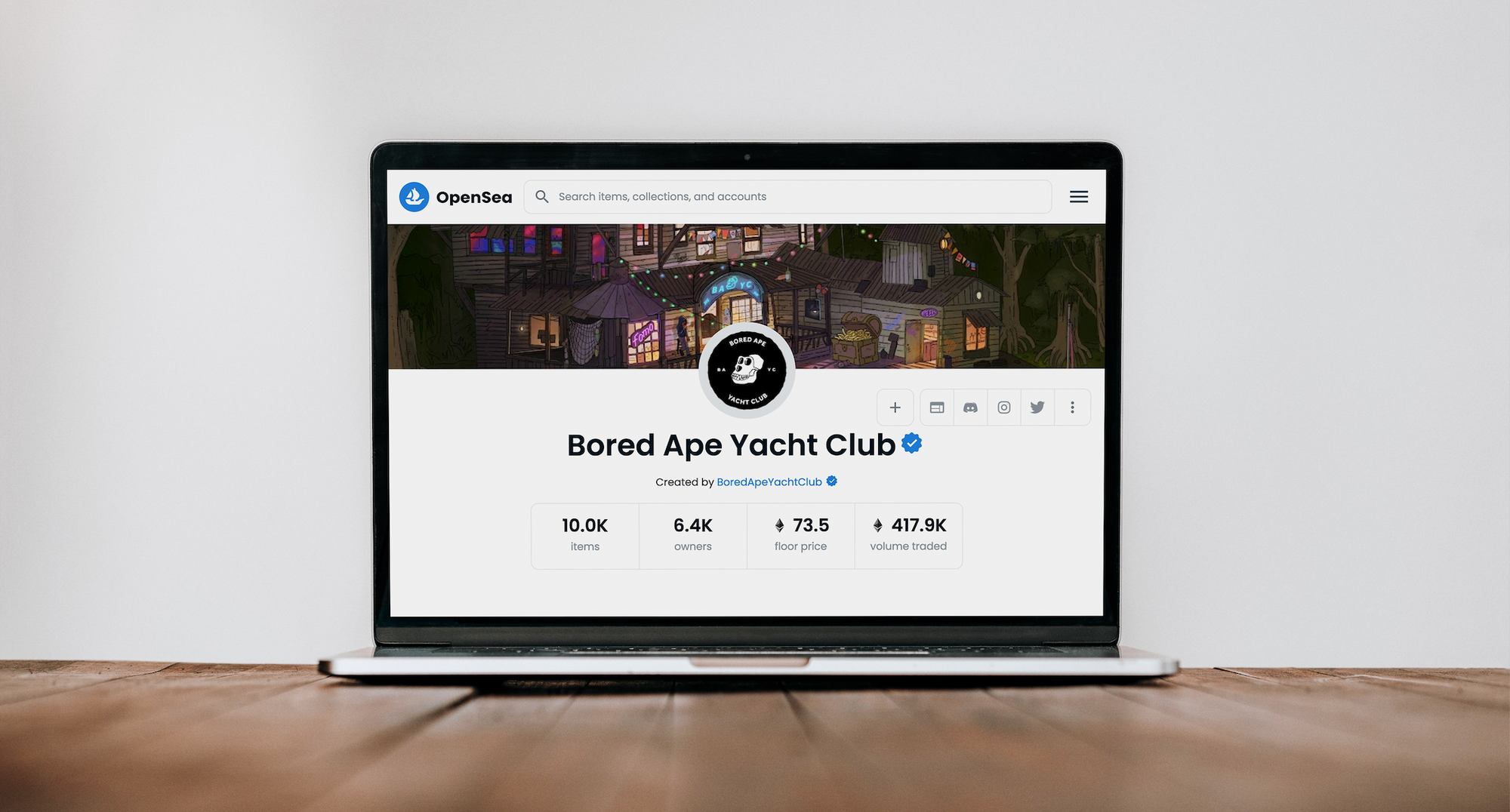

Dapps have expansive applicability, including highly marketable industries such as gaming, social media, and finance. One popular dapp, OpenSea, is one of the largest decentralized NFT marketplaces.

Dapp Uses In Transactions

Dapps make blockchain transactions like peer-to-peer lending possible. They streamline the process by using algorithms to match a user's needs with a peer’s needs. For loans, the process of finding a lender with a set criteria, as well as the receiving and paying process, is automated.

Blockchain in finance isn't new; view related article.

Dapps can also provide borrowers with funds like any financial institution would. One writes, “funds are provided by people who open an account on the platform and deposit cash on it. Similar to a financial institution, deposit accounts accrue interest on the balance kept in the account.” Users who provide funds for lending on a dapp are known as stakers, a lucrative position that users take on to capitalize on accrued interest and make passive income.

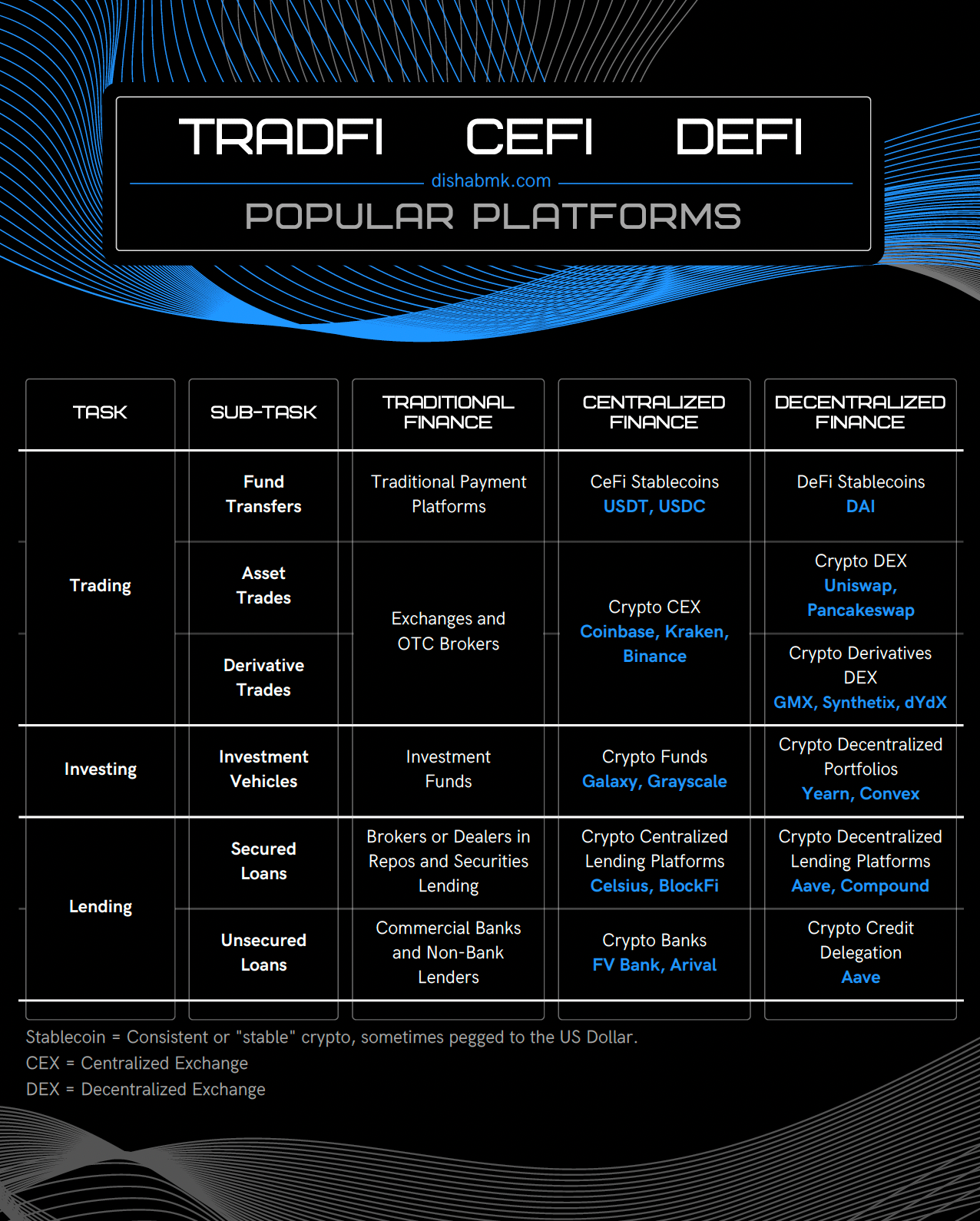

Decentralized Exchange (DEX)

Decentralized exchanges (DEXs) are defi versions of regular stock exchanges, and simply function through smart contracts. Conducting margin trades and placing limit orders are possible, but only between various cryptocurrencies. On DEXs, crypto-to-fiat trades aren't allowed.

Its technological infrastructure is built on an open-source code, allowing any curious participants to peek into the code that keeps the exchange running. Of course, this provides opportunities for developers who may adapt existing code to create new, competing projects.

Consider Uniswap, a popular Ethereum-based DEX for swapping cryptocurrencies, and how its code has been adapted by an entire host of DEXs with "swap" in their names, like Pancakeswap and Sushiswap.

Consider a relevant comparison between DEX platforms vs centralized exchange (CEX) platforms in the table below, originally from "Intro to Defi."

Decentralized Autonomous Organization (DAO)

Decentralized autonomous organizations (DAOs) are organizations with no central authority, made possible through rule-based code. What makes a DAO unique is the teeming sense of mission and community within members. DAOs are forged for a specific purpose, and its members are committed to particular goals: "several popular protocols in the DeFi space, such Maker and Compound, have launched DAOs to fundraise, manage financial operations, and decentralize governance to the community" (consensys.net). One DAO, ConstitutionDAO, had the means to outbid a billionaire for an early copy of the constitution through individual member contributions.

"More decentralization has the potential to shift power and influence into the hands of smaller online communities that can now form, communicate, and organize more efficiently than ever— allowing them to have an even greater impact on business and society" (Murray, Alex, et al.)

Smart contract technology creates entire self-governing organizations. Each DAO is able to establish their respective organizational rules via smart contract technology encoded on the Ethereum blockchain. Therefore, there is no need for a central, leadership authority. Visit ethereum.org for more on DAOs.

Concept Recap

Decentralized Applications (dapps). Software that makes defi transactions on blockchain possible through algorithmic matching; dapps also have intensive applications outside defi.

Decentralized Exchanges (DEXs). Exchanges that are built on an open-source code; these platforms can be used to conduct margin trades or place limit orders.

Decentralized Autonomous Organizations (DAOs). Self-governed organizations that are often formed for a specific initiative and independently operate thanks to smart contract technology.

References and Credits

- Damoulakis, Nick. “Council Post: How Dapps Can Help Businesses Grow.” Forbes, 17 Apr. 2023.

- Frankenfield, Jake. “Decentralized Applications (DAPPS): Definition, Uses, Pros and Cons.” Investopedia, 16 Apr. 2023.

- Murray, Alex, et al. “The Promise of a Decentralized Internet: What Is WEB3 and How Can Firms Prepare?” Business Horizons, vol. 66, no. 2, 2023, pp. 191–202, https://doi.org/10.1016/j.bushor.2022.06.002.